How Much Money Does Tristan Thompson Make A Year

INSIDE: Here's a handful of great ways to save more and spend less in the new year! These money challenges make your goals much easier to accomplish!

Morning!!

Christmas treat you alright this year? :)

Did you do good and NOT think about money at all throughout it?

Either way – time to get back to business and up our game in the New Year!

To help with that, here are some of my favorite Money Challenges to consider as you're making plans and setting up goals…

Sometimes making a game out of it can keep you more motivated!

*******

#1) The "No Spend" Money Challenge

A classic that belongs on all lists, and one of the best ones I've ever tried for my own money circa 2008 when I was just getting started myself… It's not complicated (you just DON'T spend on any "wants"! Eating out, gadgets, coffees, etc), but it sure is hard – especially if you've never tried such a thing before.

The most common length of time is to try it for a *month* (like all of January!), but others take it further and go for 3 months or even a year. You know yourself more than anyone so pick the length you think you'd best be able to stick to, and then commit 100% to yourself and go all in! You'll not only save money the entire period, but it'll change your mindset too. Which is far more powerful than a one-time savings.

While I saved approximately $200 a decade ago, it was the lasting effects of being *more conscious* with my spending that changed the game for me… Helped me realize quickly how often I blew through my money without thought!

#2) The 52 Weeks Challenge

This one is pretty popular because all it entails is dropping some money in a jar every week and you've accomplished it ;) However, the longer you go, the higher the amounts required get! On week one you drop in $1.00, on week two you put in $2.00, and then week after week you continue upping it by one dollar until you make it all the way to week #52 and you're throwing in $52!

So it gets harder as you go, but by the end of the year you'll find yourself with a cool $1,378 making it all worth it in the end :) And if you're one who enjoys getting the challenging parts of a game out of the way first, feel free to *REVERSE* it and start with $52/week and go down from there! It's your world, baby!

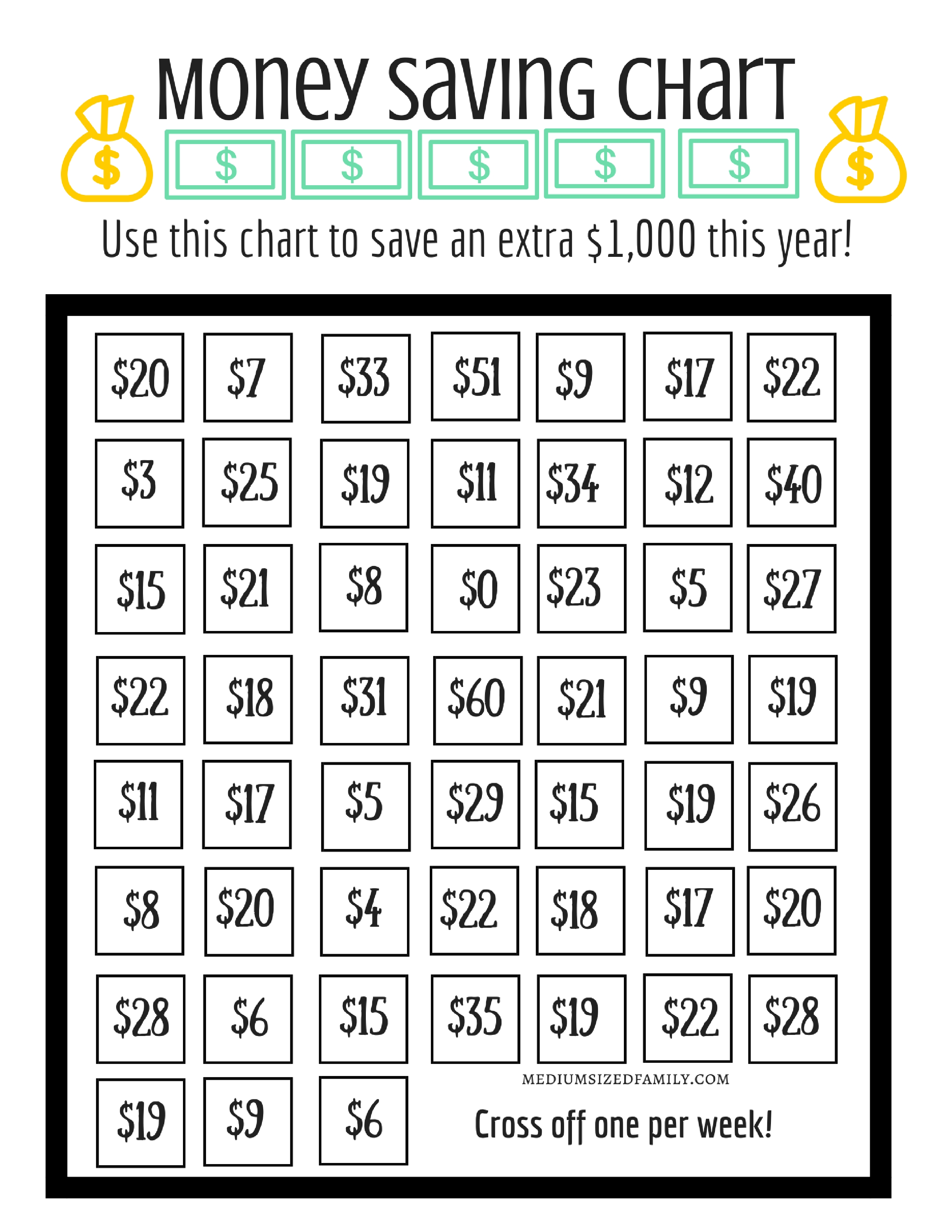

#3) The $1,000 Savings Challenge!

This is one of my favorites on the list because it not only feels great to CHECK OFF boxes as you go, but it's also much more flexible than the above routes! You basically just pick the dollar amount you can best do for the week, and then stash it away and voila!

A great idea by Jamie from MediumSizedFamily.com, who shares more and gives away the chart (for free) over on her blog post: The 52 Week Money Challenge That Will Easily Save You $1000 This Year

#4) The "Spavings" Money Challenge

Similar to the "No Spend" challenge in that you refrain from buying "wants" for a set amount of time, with this route every time you *don't* buy something you xfer that money RIGHT INTO A NEW SAVINGS ACCOUNT so you're actually saving it ;) And as you go you can send other money there too such as surprise bonuses or refund checks, birthday checks in the mail, found change on the floor, etc.

You can tweak the rules to your liking, but as long as you're putting this "non-spent" money into a savings account you've successfully won the game and then spend hours entertaining yourself on what you can now do with your "free" money that's piled up ;)

When I did this two years ago I shoveled it all into a Roth IRA and almost had enough to max it out!! All from watching my spending more and throwing in unaccounted for income!

#5) The "Challenge Everything" Money Challenge!

Where you challenge all your *current bills* and ask yourself if you REALLY still need them anymore, or if you can tweak/unsubscribe from them and still enjoy a nice quality of life!!

Many of us get into this nasty habit of just paying bills month after month without much thought, but over the years as our needs and tastes change it's very possible you're paying for something the New You no longer needs or even wants!

So the idea with this Challenge Everything challenge is to go down your bills one by one and ask yourself if it still makes sense for your life, or if you've outgrown it and/or can be equally happy with a (cheaper) alternative. Such as with cell phone plans, cable plans, Netflix subscriptions, insurances, etc.

I did this for 12 months over 2014/2015 and came up with an extra $5,484.07 to my name, which sparked some other fun games along the way too. And the most beautiful part is that the savings continue to hit EVERY SINGLE MONTH because the bills you're tackling are *recurring* ones! So that $100/mo I saved switching my cell phone service 5 years ago has now amounted to a total of $6,000 savings! And that was just one area I tweaked!

Here was the breakdown after that first year of tweaking:

#6) The Weekly Craigslist Challenge

This one's pretty straight forward as all you have to do is literally list something on Craigslist (or similar marketplaces) every week and you're done ;)

In a perfect world you'd SELL everything you put up there too, haha, but it's really the *habit* of going through your stuff more consciously that you're going for here. And typically once you've decided something needs to go, you'll find a way to get rid of it whether you get some cash in exchange or not!

#7) The 365 "Less Things" Challenge

Similar to above, this one's all about getting your *mindset* right as well, while at the same time literally getting rid of something from your home EVERY SINGLE DAY.

Similar to above, this one's all about getting your *mindset* right as well, while at the same time literally getting rid of something from your home EVERY SINGLE DAY.

It was inspired by Colleen from 365LessThings.com years ago, who wanted to help people declutter every wardrobe, bench, shelf, under bed, pantry and garage space by giving away, throwing away or selling one item every day for twelve whole months. A pretty hardcore challenge, but sometimes you need a good kick in the ass to get going! :)

And if you ever get stuck on an item, just ask yourself this one question:

Would you go out right NOW and re-buy it all over again?

If yes, it's a keeper! If no, it's a tosser ;)

#8) The $2.00 Bill Challenge

Lastly, and this one is pretty random, if you want a FUN challenge to try, make it this $2.00 one ;)

When I realized years ago that $2.00 bills were much harder to spend than "normal" bills, I made a rule that every time I passed a bank I had to go in and "buy" however many $2.00 bills the teller had on hand. Sometimes I'd walk away with 3 or 4 bills, and others more than 20 (!), but time after time my stash would grow, and before I knew it I had just over $600 saved :)

I ultimately stopped and ended up using the bills as tips and Tooth Fairy spoils, but it definitely did the trick and also got me out into the community more. Highly recommend!

Jay loves talking about money, collecting coins, blasting hip-hop, and hanging out with his three beautiful boys. You can check out all of his online projects at jmoney.biz. Thanks for reading the blog!

How Much Money Does Tristan Thompson Make A Year

Source: https://www.budgetsaresexy.com/money-challenges-for-new-year/

Posted by: batesliented1948.blogspot.com

0 Response to "How Much Money Does Tristan Thompson Make A Year"

Post a Comment