Can I Transfer Money From Paypal Credit To My Bank Account

About PayPal Credit and Our Offers

1. What is PayPal Credit?

PayPal Credit is like a credit card, without the plastic. It's a credit limit that's attached to your PayPal account which you can use for your online purchases.

If your application is successful, PayPal Credit will be available as a funding source within your PayPal wallet and can be used for purchases in most places where PayPal is accepted. You can make purchases in the same way as you would with a normal credit card, by choosing PayPal Credit as your funding source at checkout.

PayPal Credit will provide you with a monthly statement showing your transactions and detailing the minimum repayment amount. Repayments can be made by monthly direct debit, directly from your PayPal account or by speaking to our customer service agents. For further information on how you can pay your PayPal Credit balance, see the 'Make a Payment' section below.

For purchases less than £99.00, interest is charged at our standard rate of 21.9% p.a. (variable) if the full amount is not paid off by the date shown on your statement.

In addition, PayPal Credit lets you access two types of promotional offers:

If you use any of these promotional offers, they will also be detailed on your monthly statement, as well as in the PayPal Credit section of your PayPal account.

2. How are my minimum repayments calculated?

Your monthly minimum repayment will be shown in each statement and in the PayPal Credit section of your PayPal account. Any offers you have are also detailed in these locations.

Your minimum repayment amount is calculated based on your purchases, and will include:

If you fail to make minimum repayments on time or in certain other circumstances, PayPal may remove your offer. Please see your Credit Agreement for more details.

Here's an example of how your minimum repayment is calculated:

| Assuming you had the following transactions on your account: | ||

|---|---|---|

| Instalment offer | Standard balance | 0% for 4 month balance |

| £600.00 at 0% interest, spread over 6 months | £300.00 | £100.00 |

| The minimum repayment for each component would be calculated as follows: | ||

| £100.00 | 2% of £300.00 = £6.00 | 2% of £100.00 = £2.00 |

| Your minimum repayment would be £100.00 + £6.00 + £2.00 = £108.00 | ||

3. How does the 0% for 4 months offer work?

0% interest for 4 months is available on single transactions of £99.00 or more. This means when you spend more than £99.00 in one shopping basket, you'll benefit from the offer and won't be charged any interest on that transaction for 4 months after purchase. This applies automatically to any purchase made using PayPal Credit in excess of this value, except those to which another promotional offer (such as an instalment offer) applies. You can use this offer as many times as you like as long as you have an available credit limit.

While no interest is charged, any balance subject to a 0% for 4 months offer will be included in the calculation of your minimum repayment amount.

Any remaining balance due after the 4-month promotional period will be charged at 21.9% p.a. (variable). If you fail to make minimum repayments on time or in certain other circumstances, PayPal may remove your offer. Please see the Credit Agreement for more details.

4. How do instalment offers with PayPal Credit work?

With selected merchants, when you check out with PayPal Credit, you'll be shown a selection of instalment offers which enable you to spread the cost of your purchase across a number of repayments. These instalment offers vary by merchant and allow you to choose a set monthly repayment over a period from 6 to 48 months to help spread the cost of larger purchases in a more manageable way.

Instalment offers will always have an interest rate lower than the standard variable rate, and many merchants offer 0% instalments with PayPal Credit. If you already have PayPal Credit, you can take advantage of these offers without having to reapply as long as you have enough available credit limit.

It is important that you think about whether you can afford the monthly repayment agreed for any instalment offer. This will be added to your monthly minimum repayment amount and will need to be paid each month.

If you fail to make repayments or in certain other circumstances, PayPal may remove your offer and any outstanding amount will be charged at 21.9% p.a. (variable). Please see the Credit Agreement for more details.

5. How do the different types of offers on my account interact?

You can have multiple promotional offers on your account, up to your agreed credit limit and without needing to reapply. This means you can combine standard purchases with the two types of promotional offer available to help spread the cost and manage your budget.

6. How will my payments be allocated if I don't pay off my full balance each month?

Assuming you're up to date with your repayments from previous billing periods, repayments on your account are allocated in the following order:

Repayments are allocated in order, starting with the purchase subject to the highest interest rate and ending with the purchase subject to the lowest interest rate. This reduces the overall amount of interest you would otherwise pay. In the event that two promotional offers have the same interest rate (for example, two 0% for 4-month purchases) these are repaid based on the expiry date, with the soonest to expire being repaid first.

Here's an example of how we allocate your repayments:

| Assuming you had the following transactions on your account: | ||

|---|---|---|

| Instalment offer | Standard balance | 0% for 4 month balance |

| £600.00 at 0% interest, spread over 6 months | £300.00 | £100.00 |

| The minimum repayment for each component would be calculated as follows: | ||

| £100.00 | 2% of £300.00 = £6.00 | 2% of £100.00 = £2.00 |

| Your minimum repayment would be £100.00 + £6.00 + £2.00 = £108.00 | ||

| Assuming you repaid £110.00. This would be allocated as follows: | ||

| £100.00 towards your instalment offer amount due | £10.00 towards your standard balance as this accrues interest at 21.9% p.a. | £0.00 towards your 0% for 4 months balance |

| This means that you will keep your instalment offer on track, but otherwise allocates your repayments in a way that minimises the interest you will pay. | ||

7. Can I change how my payments are allocated to pay an instalment offer back early?

We've set up our repayments to act in your best interests. They are designed to keep your instalment offers on track, and to minimise the amount of interest you'll pay on the rest of your purchases.

If you're experiencing any particular difficulties, please contact us and let us try to help. For further information, please see our 'What if I can't pay?' FAQ below.

Getting Started

1. How do I apply?

Applying for PayPal Credit is easy. Simply complete our short application form here and, if approved and once you accept the Credit Agreement, you'll have a credit limit linked to your PayPal account almost straight away.

Before you apply, please make sure you:

- Are a UK resident aged 18 years or older

- Have a good credit history

- Have not recently been declared bankrupt

- Are employed and have an income greater than £7,500 per year

2. What if I don't have a PayPal account?

The first stage of the PayPal Credit application process will ask you to sign into your PayPal account or offer you the opportunity to sign up for one. Once you've signed up for a PayPal account, you can begin the application for PayPal Credit. Click here to apply.Click here to apply Signing up for a PayPal account is free and easy; all you need to do is provide your email address, create a password and accept our User Agreement.

3. How long does it take to apply for/receive PayPal Credit?

The application form takes minutes to complete. We'll then run a credit check and if approved, you'll have a credit limit linked to your PayPal account once you've accepted your credit agreement. This approval process will only take a few seconds and then you're ready to go. There can be a time lag between approval and when you can view your PayPal Credit account online but this should update within a few days.

4. I have a business account. How can I sign up for PayPal Credit?

You can contact PayPal Customer Services to change your business account to a personal account to apply for PayPal Credit. Alternatively, you can create a new personal account to apply.

5. How much will my credit limit be?

To determine the size of your credit line we use the information you provide in the application form along with internal PayPal data and an external credit check.

Make a Payment

1. How do I make a payment?

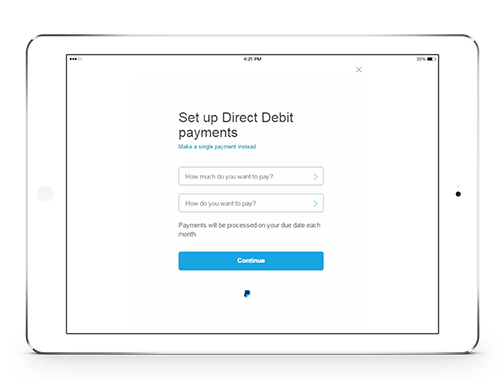

2. How do I set up a direct debit?

You can set up monthly direct debit payments, provided you have a bank account linked to your PayPal account.

- Log into your PayPal account and select PayPal Credit

- Select "Set up a direct debit payment"

- Choose how much you want to pay each month and from which bank account.

Not added a new bank account to your PayPal account?

To add a new bank account to your PayPal account:

- Log in to your account

- Select "wallet"

- Choose "add a bank account".

- Once a bank is added, you can make payments directly to your PayPal Credit account or set up a direct debit.

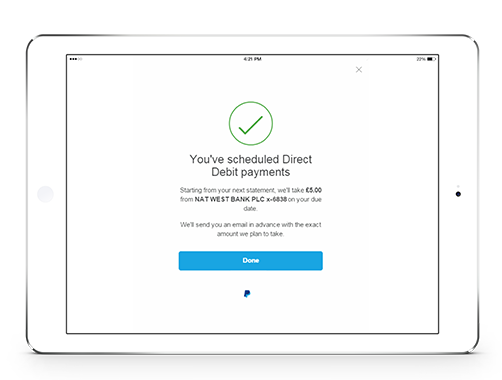

3. When will my Direct Debit start?

There are 4 different options available when you choose to set up Direct Debits. You can choose to pay:

- the minimum amount due

- the last statement balance

- any "other amount" in between each month.

- If I make changes to my direct debit how long will it take to implement?

If you make changes to your direct debit it can take up to a month to implement which means you may need to add a manual payment in month to ensure you are covered and the direct debit changes will be implemented the following month.

If you choose to pay the minimum amount due or the last statement balance, you will need to set up the Direct Debit at least 4 working days before your due date for the Direct Debit to start on that due date. If you set it up any later than this, the Direct Debit may not start until the next month. We will tell you when you're setting up the Direct Debit exactly when it will take effect from and if you need to make an interim payment.

If you choose to pay any "other amount", it is important to note that the Direct Debit will not start on your next due date. It is likely to start the following month. Please be sure to make a single payment the month you set it up to avoid missing any payment due. We will tell you when you're setting up the Direct Debit exactly when it will take effect from.

4. I just opened up a PayPal Credit account, when is my payment due?

We will automatically send you monthly reminders to notify you of when your payment is due. We'll ask you to make your first payment around 35 days from when your PayPal Credit account was opened.

5. Can I setup payment due reminder alerts?

We will automatically send you monthly email reminders 5-15 days in advance of your payment due date. In order to receive these reminders, ensure the correct email address is linked to your PayPal account.

6. How long does it take for payments to reflect on my account?

Payments will reflect on your PayPal Credit account the same day you make them, however, will show as pending. It can take up to 5 working days for the funds to leave your bank account and be applied to your PayPal Credit account.

7. What if I can't pay?

If you're finding it difficult to make a payment, Please call our PayPal Credit customer service team on 0800 368 7155 and we will do our best to help you. The organisations below should also be able to answer your questions and suggest suitable courses of action:

Citizens Advice:

- England and Wales www.citizensadvice.org.uk

- Northern Ireland (Advice NI) www.adviceni.net

- Scotland (Citizens Advice Scotland) www.cas.org.uk

Alternatively:

- Payplan: call 0800 917 7823 or visit www.payplan.com

- StepChange Debt Charity: call 0800 138 1111 or visit www.stepchange.org

- National Debtline: call 0808 808 4000 or visit www.nationaldebtline.co.uk

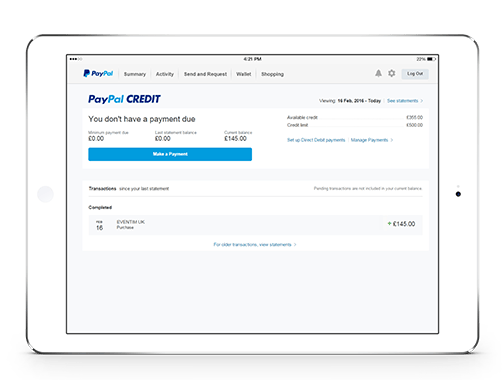

8. I've been using PayPal for a while now. How can I find out when my PayPal Credit payment is due?

You can find this out by logging into your PayPal account on a desktop computer and by clicking on the summary page. You can also view when to make a payment via the app. Click on PayPal Credit and the 'Make a Payment' button.

Manage your account

1. How do I manage my account?

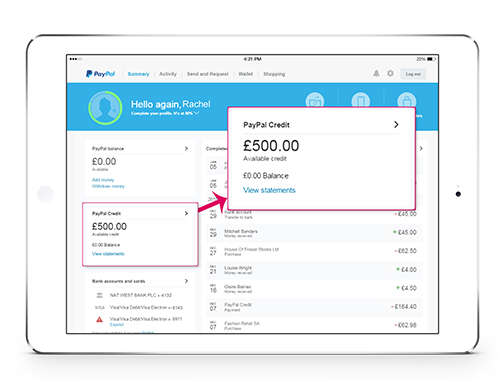

You can keep track of your PayPal Credit activity and history by logging in to your PayPal account and selecting PayPal Credit.

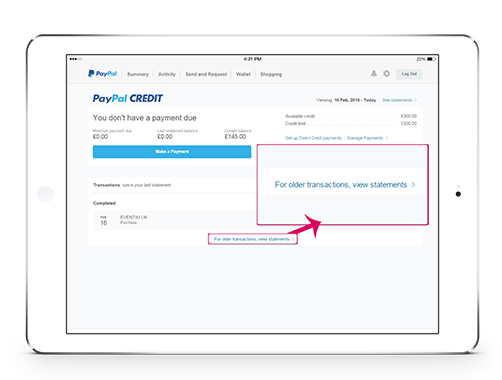

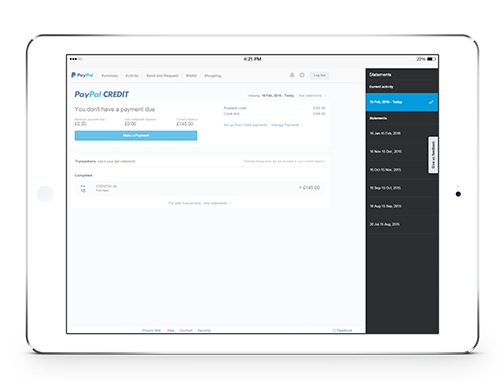

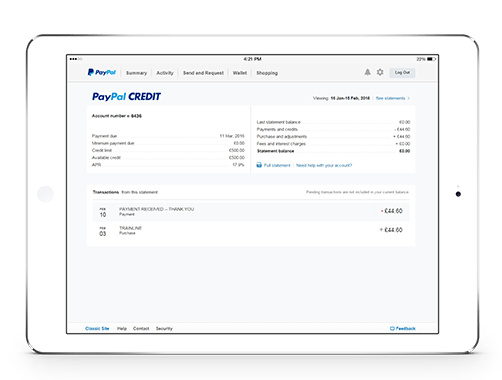

2. Where can I find my statements?

- Login to your PayPal account on your desktop and select PayPal Credit

- Select "See statements"

- You can view all statements online as well as download them as PDFs

We will email you monthly to let you know when your latest statement is ready to view.

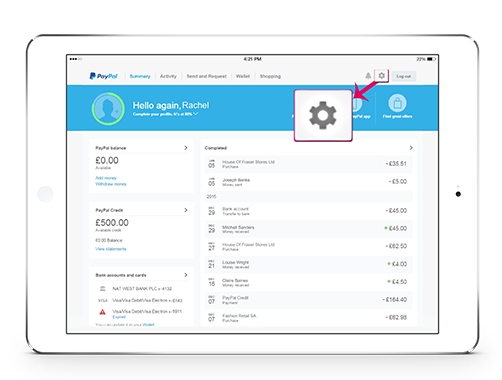

3. How can I update my contact details?

- Login to your PayPal account

- Select the "Settings" icon

- Update your contact details

4. How do I close my PayPal Credit account?

Before you close your account, you need to ensure that your balance has been paid off in full.

To close your account, you can call our PayPal Credit customer service team on 0800 368 7155.

Using PayPal Credit

1. Where can I use PayPal Credit?

PayPal Credit is available to use at thousands of stores online where PayPal is accepted. Transactions can be made in all currencies that PayPal supports, not just GBP.

We also offer instalment offers at select merchants.

2. How do I select PayPal Credit as my funding source?

- At checkout, choose to pay with PayPal

- Simply change the payment source to PayPal Credit

- Confirm and Pay

On those merchants where instalment offers are available, remember to lookout for PayPal Credit at checkout to see the offers available to you.

3. Will I receive alerts on my mobile phone for transaction made on my account?

If you have the PayPal App, we'll notify you every time you use PayPal to pay, including PayPal Credit transactions. If you don't have the App, you can download it here

4. Are there any businesses or types of goods for which I cannot use PayPal Credit?

There are some business categories where PayPal Credit cannot be used as a payment option, so it won't be offered to you as a payment option during checkout.

Excluded categories include merchants selling adult content, stored value cards, and gambling.

5. Can I transfer money to family and friends or my bank account using my PayPal Credit?

Currently, your PayPal Credit limit cannot be used to send money to friends and family or to deposit funds into your bank account.

6. Can I get cash with my credit account?

Currently, your PayPal Credit limit cannot be used for a cash advance.

7. Can I use my PayPal Credit for "Invoice" or "Money Request"?

PayPal Credit will not be available as a funding source to pay an invoice or money request sent via PayPal.

8. Does PayPal Credit protect me from unauthorised charges?

Yes. You're not liable for unauthorised purchases made from your PayPal Credit account. PayPal Buyer Protection also applies to purchases funded with PayPal Credit. If this happens, you should immediately report it to us so we can investigate and resolve it for you. You can report an unauthorised transaction through the Resolution Centre of your PayPal account. This is independent of any other statutory rights you may have.

Here's how to report an unauthorised transaction:

- Log in to your PayPal account.

- Under 'More about your account', click Resolve a problem in our Resolution Centre.

- Click Dispute a transaction

- Select the item you wish to dispute, Click "Continue", and follow the rest of the instructions provided to submit your dispute.

9. I have upgraded to a business account and now I can no longer see all of my PayPal Credit information/ functions, why is this case?

You can access the PayPal Credit hub through your Business account.

- Log in

- Select "PayPal Credit"

Fees

1. Are there any fees I should be aware of?

Late Payments

If you're late with a payment, PayPal may charge you a late payment fee of £12.00.

Returned Payments

You may be charged a return payment fee of £12.00 if you have insufficient funds to cover the payment.

Statements (Paper Copy)

We also charge a fee of £5.00 if you request that we send you a printed copy of a previous statement. All statements are available to download or view online within the PayPal Credit section of your PayPal account.

For more information on how these fees apply, please refer to the Outline of Credit, the Standard European Consumer Credit Information document or the Credit Agreement.

2. Is there an annual fee?

No. There is no annual fee for a PayPal Credit account.

Persistent debt

1. What is persistent debt?

Persistent debt is defined as any customer who pays more in interest, fees and charges than they repay of the amount they borrowed (known as "principal") in a rolling 18-month period (with a balance greater than £200.00 GBP during that time). We will notify you if you consistently fall into this category at 18, 27, and 36 months.

2. I've received a letter stating I've paid more in interest, fees and charges than principal over the last 18 months. What does this mean?

As a responsible lender, PayPal monitors the repayments of our customers. We look for signs of potential difficulty and try to recognise where improvements can be made. In this instance we've identified that if you increased your repayments you would repay your debt more quickly and reduce your interest costs.

3. How can I increase my payments?

PayPal Credit offers a few different ways for you to make payments.

You might consider setting up a Direct Debit, which is an easy way to pay the amount you choose automatically rather than having to make them manually yourself each month. To set up a Direct Debit or change your existing Direct Debit, log in to your PayPal account.

Alternatively, you can make or schedule an additional payment in your account by following the link above and clicking the "Make a Payment" button. You can also make a payment by calling 0800 368 7155.

4. What do I do if I can't afford to increase my minimum payment?

If you don't think you'll be able to increase your payments because of other financial commitments, you can call us on 0800 368 7155. We'd like to help talk you through the options that may be available to you. We're open 8.00am to 6.30pm Monday to Sunday.

5. Where else can I go for financial help and support?

Cross Currency

1. Which currencies does PayPal Credit support?

PayPal Credit can now be used to purchase items in all currencies PayPal supports. PayPal will convert all transactions into UK Pound Sterling in advance of applying them to the Credit Account. Transactions will be displayed in your local currency when they show on your PayPal Credit statement.

2. What exchange rate is charged?

If a currency conversion is needed for your payment, it will be completed at the transaction exchange rate we set for the relevant currency exchange. When you select PayPal Credit as your payment method you will see the exchange rate displayed at checkout. For further information on how we convert currency, see the user agreement.

3. Can I still get the 0% for 4 months offer and instalment offers with transactions in non-GBP currencies?

If you qualify for a promotional offer, either our instalment offers or our 0% for 4 months offer, this will be applied regardless of which currency you transact in.

(Occasionally, exchange rates may fluctuate and impact whether a non-GBP transaction qualifies for a promotional offer. If you believe you should have qualified for a promotion – please call our Customer Services.)

4. Am I still protected by Buyer Protection if I make a purchase in non-GBP currencies?

Yes. If an eligible item that you've bought online doesn't arrive or is significantly not as described in the seller's description, you can make a claim under PayPal Buyer Protection. Buyer Protection covers all your eligible PayPal purchases including those paid with PayPal Credit.

5. What happens if my purchased item is returned?

You can return the goods to receive the refund, if eligible, direct to your PayPal Credit account. The refund will be displayed in the amount you paid in GBP.

6. How will the transaction be displayed at checkout?

At checkout, you will be shown the transaction value in the original currency that appears on the merchant's website as well as the converted transaction value in GBP.

7. How will a non-GBP transaction appear on my statement?

Your PayPal Credit statement will show the transaction in GBP only. No exchange rate information will be shown. You can however view the exchange rate information in your customer dashboard online as well as viewing your activity on your PayPal account statement.

Credit Limit Increases

1. How do I increase my credit limit?

We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 3 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

2. Can I apply for a credit limit increase?

No. Unfortunately, you cannot request a credit limit increase. Credit limit increases will be offered to you when you become eligible.

3. What are the eligibility criteria for a credit limit increase?

To be eligible for a credit limit increase you must:

- Have been a PayPal Credit customer for at least 6 months

- Have not been in arrears in the last 6 months

- Have transacted with PayPal Credit in the last 6 months.

4. How do I change my credit limit preferences?

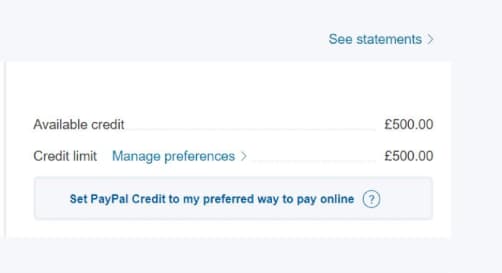

Log in to your PayPal account and follow the 'manage preferences' prompts. You can also find the 'Manage preferences' link in the PayPal Credit tile on your Summary page, as shown below:

5. My credit limit has increased automatically. How can I reduce this back to its original limit?

You can change your limit back to its original limit at any time by calling PayPal Credit Customer Service on 0800 368 7155.

6. If I change my preferences when I have a pending credit limit increase offer, will it apply to the pending offer?

No, your new preferences will apply to all future offers only.

7. What options are available to me for credit limit increases?

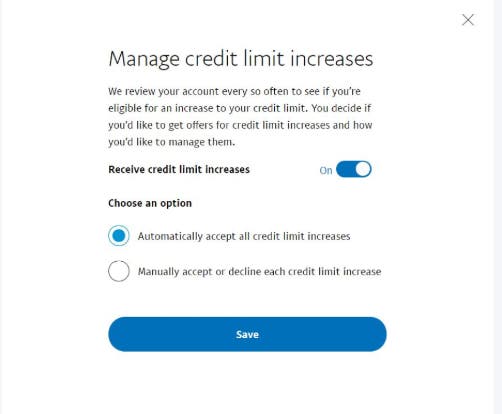

There are 3 options for credit limit increases:

- Automatically accept all credit limit increases. This means any future credit limit increase that is offered will be applied automatically to your account.

- Manually accept or decline each credit limit increase. This means that when an offer becomes available to you, you will need to log in to your account and accept or decline the offer yourself.

- Turn off credit limit increases. This means you will not be offered a credit limit increase even when you become eligible.

8. Can I increase my credit limit increase before the offer expires?

Yes, when you are offered a credit limit increase you can choose to apply it to your account straight away or at any time before the offer expires.

9. My credit limit increase offer has expired. Can I still get it?

No, once an offer has expired you'll need to wait until your next offer. We review your credit limit monthly and will continue to offer you a credit limit increase as long as you meet our eligibility criteria.

Credit Limit Decreases

1. Can I keep my existing limit and opt out of the credit limit decrease?

As responsible lenders we constantly monitor exposure and utilisation of customers' limits. Following a reassessment of customer credit limits, we have decided to reduce your limit to a more appropriate level. Unfortunately, there is not an option to keep your existing limit and PayPal has the right to reduce your limit at any stage as referenced in section 1.6 of your PayPal Credit agreement.

2. Can I choose a different credit limit to the one I received?

Unfortunately we are unable to change the limit reduction amount.

3. Can I choose a different date the credit limit decrease occurs?

No, unfortunately not, your limit decrease will take effect on the date specified in your email communication.

4. Is a credit check completed as part of my credit limit decrease?

No. As a responsible lender we regularly get updates from credit reference agencies on your account. These updates along with a change in limit do not appear on your credit file.

5. Will this credit limit decrease affect my credit score?

Other FAQ's

1. I have been declined for PayPal Credit. Why?

We'll email you with more information about why your application for PayPal Credit was unsuccessful. If you apply during check out and get declined for PayPal Credit, you can still use PayPal to check out securely with your debit or credit card.

If you want to re-apply, you will be able to 35 days after your last application.

2. What is a Representative APR and what is the Representative APR for PayPal?

A Representative APR (Annual Percentage Rate) is shown on products where you borrow money so that an easier and fairer comparison can be made. It's the typical total cost of a credit product expressed as a percentage, spread over 12 months.

The Representative Annual Percentage Rate for a PayPal Credit account is 21.9% (variable) per annum. This is also the standard rate of interest that will apply to your purchases.

Sometimes we'll run promotional offers with a lower rate of interest (such as 0% interest per annum for 4 months). Your standard rate of interest will not apply to transactions charged at a lower interest rate during the promotional offer period. See your Credit Agreement for more details.

We may offer to increase your standard interest rate by giving you at least 30 days' notice. For more information on when we would do this please see your Credit Agreement.

3. What does subject to approval mean?

We are required to carry out creditworthiness and affordability checks to determine if PayPal Credit is right for you. As part of this process, we review information held on you by credit reference agencies and other relevant information prior to approving you for PayPal Credit.

4. Is there a cooling off period if I want to close my PayPal Credit account?

You may withdraw from your PayPal Credit account by calling us within 14 days of entering into the Credit Agreement. You may close your PayPal Credit account at any time, but must repay any outstanding balance.

5. What currency does PayPal Credit Support?

PayPal Credit can be used to purchase items in all currencies that PayPal supports.

6. I accidently used PayPal Credit for a purchase how can I clear my purchase.

The first option is to contact the merchant and see if they can cancel the order. If it's too late for the merchant to do so, then you can return the goods to receive the refund direct to your PayPal Credit account.

7. Does PayPal Buyer Protection apply to my PayPal Credit purchases?

Yes. If an eligible item that you've bought online doesn't arrive or doesn't match the seller's description, PayPal Buyer Protection will reimburse you. Buyer Protection covers all your PayPal purchases including those paid with PayPal Credit.

For full information on eligibility, see our User Agreement.

8. What is the difference between Pay After Delivery and PayPal Credit?

Pay After Delivery is a payment method that we're offering to selected customers, where you don't pay for your item until after you've received it.

We pay the seller immediately, so they can send you the item straight away, but we wait for 14 days before we debit the money from your bank account. This gives you time to receive and view your item before you pay. If the item doesn't arrive or isn't what you expected, you've 180 days from the transaction date to report a problem as usual. Our Buyer Protection can cover you for eligible items.

Contact Us

1. How can I contact you if I have any further questions?

For more information, you can call PayPal Customer Service on 0800 368 7155.

Hours of service:

Monday to Sunday 8am to 6.30pm (GMT)

If you're calling from outside the UK, call 0044 800 368 7155

Fax: 020 8080 6518

Alternatively, if you're an existing customer you can use our secure message centre for all account related enquiries by logging into your PayPal Account.

Representative Example:

Representative

21.9% APR (variable)

Purchase interest rate

21.9% p.a. (variable)

Assumed Credit limit

£1,200.00

* The minimum payment due still applies to 0% offer balances. Any remaining balance due after the 4-month promotional period or any transactions under £99.00 will be charged interest at 21.9% p.a. (variable). In order to maintain the 0% offer, you need to keep up monthly repayments and stay within your credit limit. Credit subject to status. Terms and conditions apply. UK residents only. PayPal Credit is trading name of PayPal (Europe) S.à r.l. et Cie, S.C.A. Société en Commandite par Actions Registered Office: 22-24 Boulevard Royal L-2449, Luxembourg RCS Luxembourg B 118 349. Deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority's website.

Can I Transfer Money From Paypal Credit To My Bank Account

Source: https://www.paypal.com/uk/webapps/mpp/paypal-virtual-credit/faq

Posted by: batesliented1948.blogspot.com

0 Response to "Can I Transfer Money From Paypal Credit To My Bank Account"

Post a Comment